Securing a gambling license from Gibraltar is a strategic investment that provides long-term benefits and savings, primarily due to the license’s five-year validity period. This extended duration is advantageous compared to jurisdictions that require annual renewals, which can lead to recurring costs and the need for continual preparation of documentation.

Cost Analysis of a Gibraltar Gambling License

The cost of obtaining a gambling license in Gibraltar is outlined in the Gambling (Duties and Licensing Fees) Regulations 2018. The fee structure for the various types of licenses is standardised, with most categories requiring a payment of £100,000 per licensing year. This applies to Remote Gaming B2C Operators, Remote Betting B2C Operators, Other Remote B2C Gambling Products, Non-Remote B2C Gaming Operators (land-based casinos), and Non-Remote B2C Betting Operators (land-based bookmakers). For businesses providing Gambling B2B Support Services, the fee is slightly lower, at £85,000 per licensing year.

The duty rates for General Betting Duty, Betting Intermediary Duty, and General Gaming Duty are set at 0.15%, with an exemption on the first £100,000 of the operator’s gross profit in each category per year. This tax structure is favourable and designed to support both the growth of operators and the competitive position of Gibraltar as a leading jurisdiction for online gaming businesses.

In addition to the licensing fees, Gibraltar imposes a gambling business tax of 1% on revenues, with a cap of £425,000 and a minimum threshold of £85,000 annually. This tax structure is particularly favourable for enterprises with significant turnover, providing a scalable and economically viable model for both burgeoning and established companies.

Comparing Gibraltar and UK Gambling Licenses

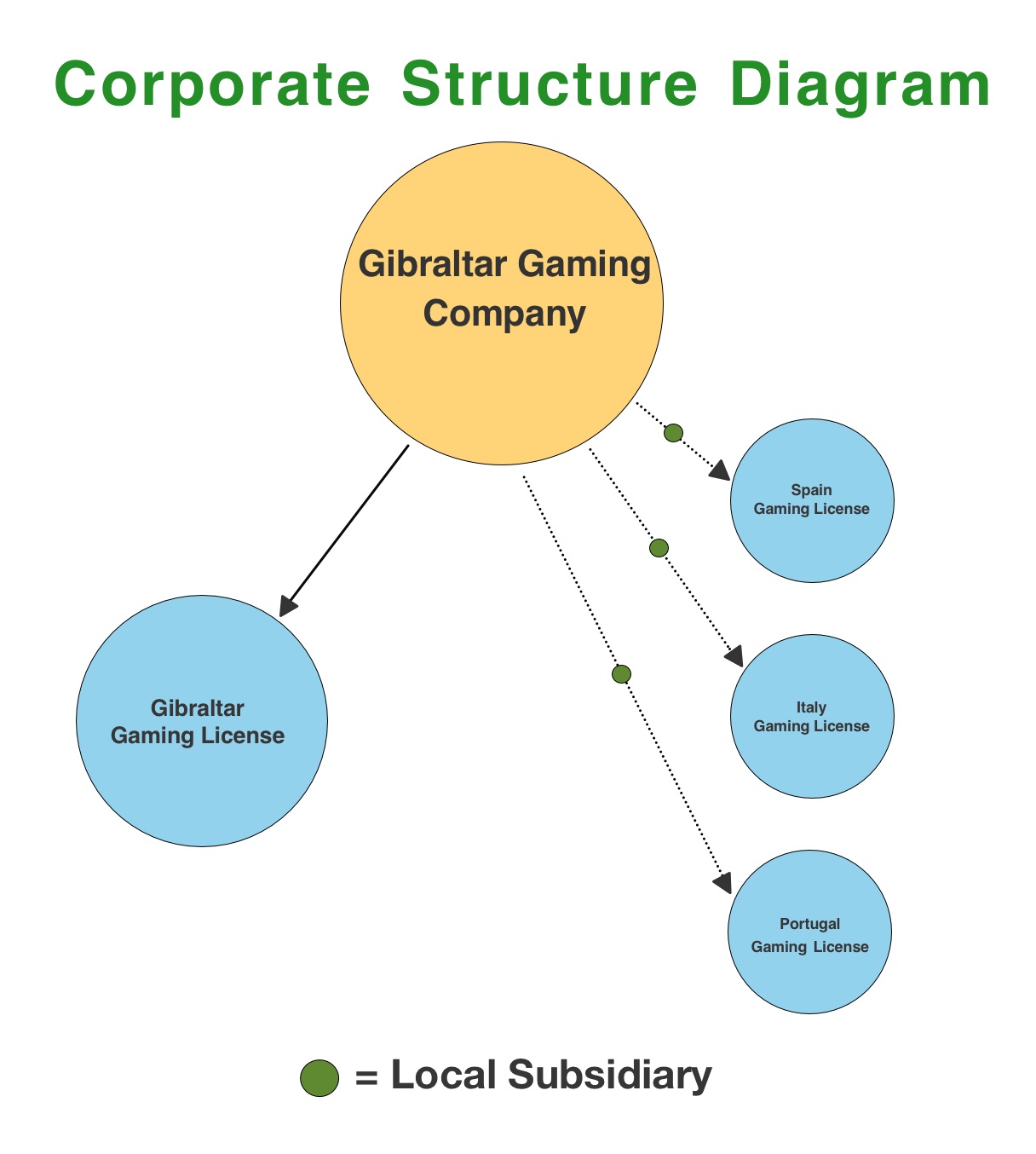

While Gibraltar is a British Overseas Territory, it maintains its own distinct gambling regulations and oversees its licensing through a dedicated regulatory body. This autonomy allows Gibraltar to offer a unique set of advantages for iGaming operators, contrasted with the licensing conditions provided by the United Kingdom. To offer a comparative perspective:

Gibraltar Licensing Overview:

- License Types Offered: Diverse range including Remote Gaming B2C Operator, Remote Betting B2C Operator, Other Remote B2C Gambling Products, Gambling B2B Support Services, along with licenses for land-based casinos and bookmakers.

- Markets Covered: Provides access to international markets wherever the Gibraltar license is recognised and were no local license is required.

- Cost Structure: £100,000 for B2C licenses and £85,000 for B2B licenses, per licensing year.

- Taxation: Business tax at 1% of revenues, capped at £425,000 and not less than £85,000 annually.

UK Licensing Overview:

- License Types Offered: Categorised by activity performed, including Operating License, Software Operating License, Personal Management License, and Personal Functional License, with distinct licenses for each product type.

- Markets Covered: Primarily the UK, with specific requirements for operators serving British customers.

- Cost Structure: The application fee varies significantly based on the type of license, the product covered, and Gross Gambling Yield (GGY), with fees ranging from £4,224 to £91,686 for operating licenses and a personal management license fee of £370.

In summary, Gibraltar offers a strategic licensing option for iGaming operators seeking long-term stability, cost efficiency, and access to a broad international market.

The territory’s comprehensive licensing options, favourable tax regime, and global recognition make it an attractive jurisdiction for both new entrants and seasoned players in the online gaming industry.

In contrast, the UK licensing system presents a more segmented approach, with varied costs and a focus on domestic market compliance, offering an alternative route for businesses targeting the UK.